Building a T&C Scheme for Compliance Confidence

Sector: Wealth Management / IFA Network

Role: Strategic & Compliance Consultant

Service Areas: Governance · People Development · Regulatory Readiness

The Challenge

A growing IFA network was operating with outdated and inconsistent T&C practices. Supervisors were overwhelmed, records were fragmented, and leadership lacked confidence in demonstrating adviser competence.

With increased scrutiny under Consumer Duty and SMCR, the business needed a scalable, defensible approach to competence and oversight.

Our Approach

Bonner-Murray Consulting was engaged to rebuild the T&C framework from the ground up.

The engagement began with a full review of the existing T&C landscape.

This included:

Reviewing training, supervision, and CPD practices

Assessing supervisory workload and role clarity

Identifying gaps in documentation and MI

Understanding cultural and operational constraints.

A new T&C scheme was designed to align FCA expectations with practical delivery.

This involved:

Defining clear supervisory roles and responsibilities

Designing scalable oversight tools

Aligning competence assessment with risk and advice activity

Ensuring proportionality across adviser profiles

Supporting materials and training were developed to embed the framework.

This included:

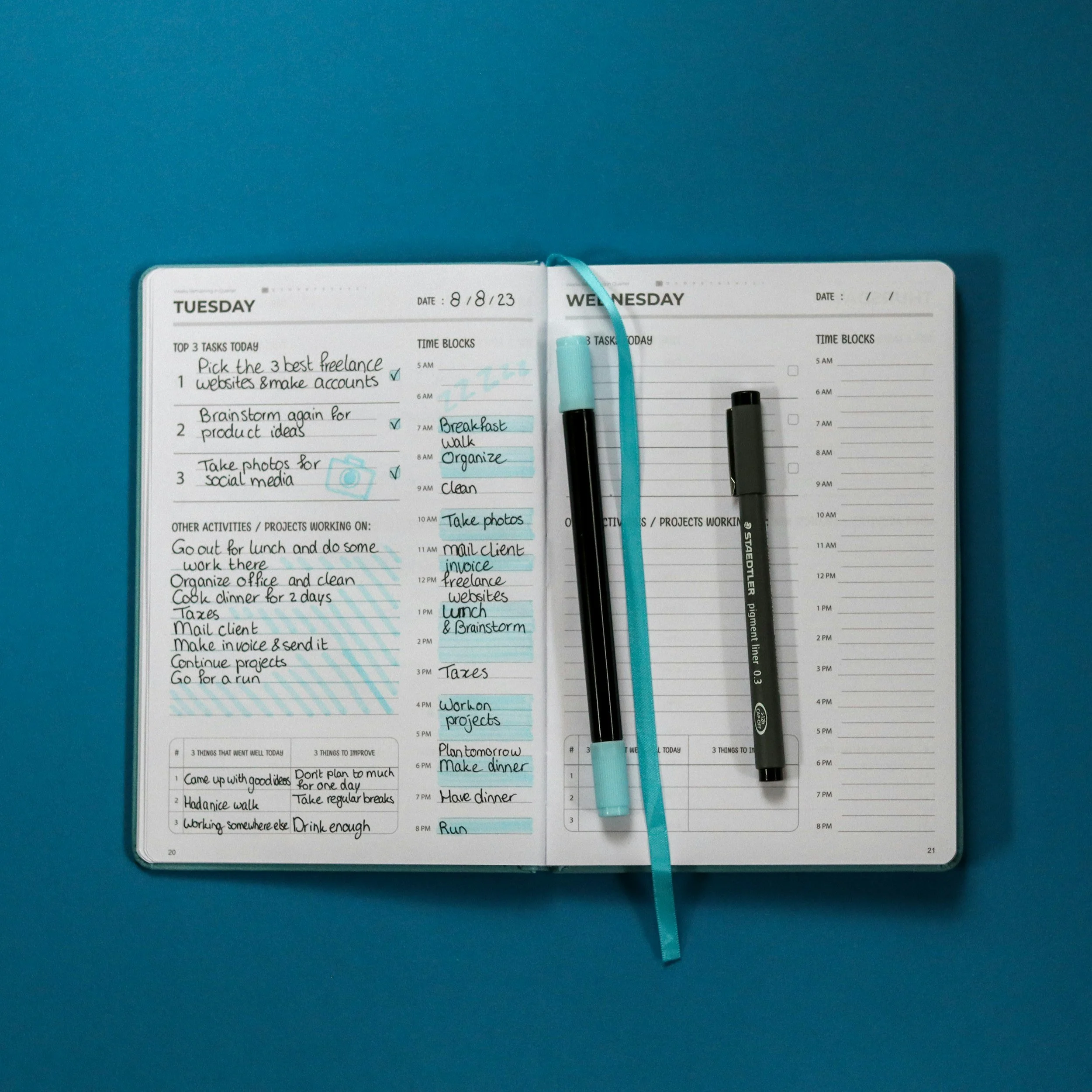

Supervision templates and competence matrices

MI dashboards to improve leadership visibility

Workshops and 1-to-1 training for supervisors

The Outcome

The network achieved a step change in regulatory confidence.

The outcome included:

A defensible, documented T&C framework

Supervisors equipped with clear tools and expectations

Improved compliance MI and oversight

A confident, supported supervision culture

“It’s the first time we’ve felt confident about how we manage competence and the first time the team’s actually felt supported doing it.”

Head of Compliance (anonymous)